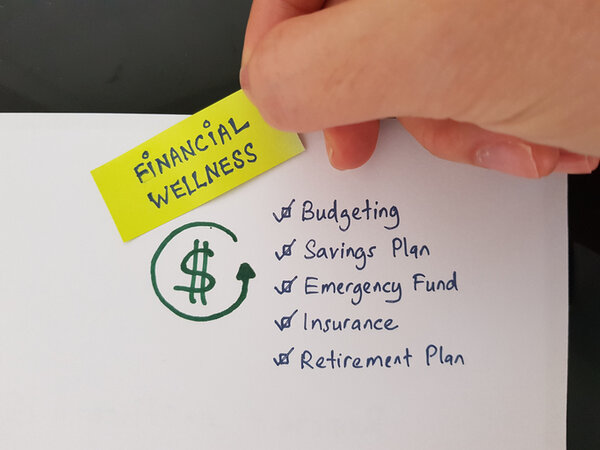

Financial Wellbeing

OneDigital

OneDigital can help you develop good financial health. They have created an easy way for you to improve your financial knowledge by offering a membership to OneDigital's Financial Academy.

- Monthly live webinar with on-demand availability

- Interactive website housing all webinar invitations and resources

- Quick flipbook review of each monthly session

- Live Q&A with a licensed advise

Workshops (previously recorded in 2025)

Watch WebinarRetirement Worksheet

Voya 457(b) and Voya Roth 457(b)

A 457b Deferred Compensation plan is a tax-favored supplemental retirement savings program that allows public employees to contribute a portion of their salary, before Federal taxes, to a retirement account. Any permanent employee who is interested in paying themselves first through a supplemental retirement program can participate. Board of County Commissioners employees can set up an account through Voya Financial at any time. Other employees: please see your employer's Insurance Coordinator.

Securian Lifestyle Benefits

Life happens. When it does, turn to your Lifestyle Benefits services -- available to you at no cost through your Securian Life Insurance policy. These services are designed to help you in times of need and are only a click or a call away. View this flyer for more information.